Sage (Legacy)¶

Exporting data to Sage¶

In some circumstances it will be appropriate to run a fully capable accounting packaging alongside ProEPOS, or your accountant/book-keeper may ask you for a Sage compatible file of your data. The export capabilities of ProEPOS allow you to export sales and purchase invoice data as a Sage compatible CSV "audit trail" export file.

From the financialAccounts window, select the "Export to Sage" option from the "File" menu:

This will open the Sage export dialog:

Select the dates (inclusive) of the transactions (sales and purchases) to be exported.

Clicking OK will prompt for a location and filename under which to save the resulting file.

Accountants note: The file contains one entry per day for the total revenue per VAT rate. Using the default settings, the bank account specified is the "cash register" account (1235). Sales are exported with nominal code "4000". The department code is "1". Transaction types are BR for sales and BP for purchase invoices (although it is recommended that purchase invoices are entered directly into Sage as this allows greater control over how the invoice is allocated, etc).

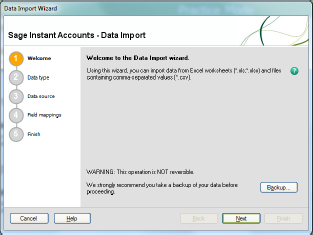

Importing exported data into Sage¶

Once you have created the audit trail export file in ProEPOS, the transactions can be imported into Sage using the "File" menu "Import" option:

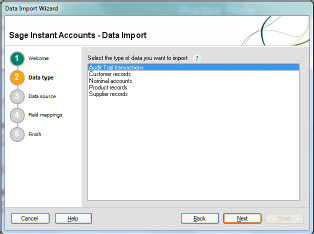

Select "Audit Trail transactions".

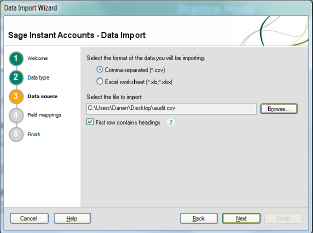

Select the "Comma-separated" and "First row contains headings" options. Browse-to and select the export file.

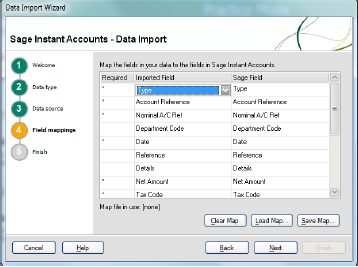

This dialog should auto-populate with no manual changes required. Just click "Next".

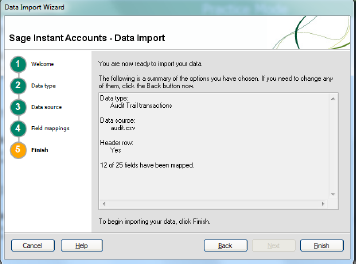

Click "Finish" to begin the import.

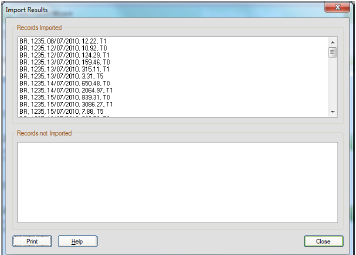

The import is complete.

Note

Note that these instructions are a guideline only and are subject to change across different versions of Sage. We are unable to support Sage and recommend that if you have any queries you contact a Sage qualified reseller for assistance.